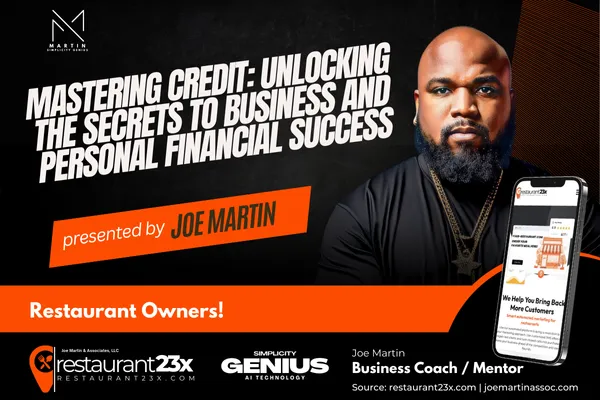

Mastering Credit: Unlocking the Secrets to Business and Personal Financial Success

Mastering Credit: Unlocking the Secrets to Business and Personal Financial Success

In today's financial landscape, credit mastery is more crucial than ever. Understanding how to effectively manage and leverage both personal and business credit can unlock numerous opportunities for financial success. This comprehensive guide will delve into the intricacies of credit, offering detailed insights to help you navigate the complex world of credit management.

Understanding the Basics of Credit

Credit refers to the ability to borrow money or access goods and services with the understanding that you'll pay later. There are two main types of credit: personal and business. Each plays a pivotal role in financial management and requires a distinct approach to maintain and improve.

Personal Credit: Building a Strong Foundation

Personal credit is the financial trustworthiness of an individual. It is measured through credit scores, which are numerical expressions based on an individual's credit history. Here’s how you can build and maintain a strong personal credit foundation:

1. Know Your Credit Score

Your credit score is a crucial indicator of your financial health. Regularly check your credit score through reliable services to stay informed about your financial standing. Key components influencing your credit score include payment history, amounts owed, length of credit history, new credit, and types of credit used.

2. Pay Your Bills on Time

Timely bill payments are vital. Late payments can significantly lower your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

3. Manage Your Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is the percentage of your monthly income that goes toward paying debts. A lower DTI indicates a healthy balance between debt and income, positively impacting your creditworthiness.

4. Diversify Your Credit Mix

Having a variety of credit types (e.g., credit cards, auto loans, mortgages) can benefit your credit score. It demonstrates your ability to manage different forms of credit responsibly.

5. Avoid Excessive Credit Inquiries

Each time you apply for new credit, an inquiry is made on your credit report. Multiple inquiries within a short period can lower your credit score. Apply for new credit sparingly.

Business Credit: Fueling Growth and Expansion

Business credit reflects the financial reliability of a business entity. Strong business credit can lead to better financing terms, increased borrowing capacity, and improved business credibility. Here’s how to establish and enhance your business credit:

1. Register Your Business Properly

Ensure your business is legally registered and obtain an Employer Identification Number (EIN) from the IRS. This is the business equivalent of a Social Security number and is essential for building business credit.

2. Open a Business Bank Account

A business bank account separates your personal and business finances, which is critical for accurate financial management and credit building.

3. Establish Trade Lines with Vendors

Building relationships with vendors that report your payment history to business credit bureaus is essential. Consistent, on-time payments to these vendors will strengthen your business credit profile.

4. Apply for a Business Credit Card

A business credit card can help establish and improve your business credit. Use the card for business expenses and ensure you pay off the balance in full each month to avoid interest charges and build a positive credit history.

5. Monitor Your Business Credit Reports

Regularly review your business credit reports from major credit bureaus like Dun & Bradstreet, Experian Business, and Equifax Business. Correct any inaccuracies promptly to maintain a strong credit profile.

Advanced Credit Strategies for Financial Success

Beyond the basics, there are advanced strategies to maximize your credit potential. These techniques can propel both personal and business credit to new heights, opening doors to greater financial opportunities.

1. Utilize Credit Optimization Services

Consider using professional credit optimization services. These services analyze your credit reports, identify areas for improvement, and implement strategies to boost your credit scores.

2. Leverage Credit for Investment Opportunities

Use your improved credit standing to access low-interest loans and lines of credit. These financial products can fund investments that generate additional income, creating a cycle of financial growth.

3. Implement Credit-Building Financial Products

Explore secured credit cards and credit-builder loans if you’re starting from scratch or need to repair damaged credit. These products are designed to help build or rebuild credit with responsible usage.

4. Maintain Low Credit Utilization

Keep your credit utilization ratio below 30%. This ratio is the percentage of your available credit that you’re using. Low credit utilization demonstrates responsible credit management and positively impacts your credit score.

5. Engage in Continuous Education

Stay informed about changes in credit reporting and scoring. Attend workshops, webinars, and read up-to-date literature on credit management to continually refine your strategies.

Conclusion

Mastering both personal and business credit is not just about maintaining good scores; it’s about leveraging those scores to unlock financial opportunities. By understanding the fundamentals, implementing advanced strategies, and maintaining continuous vigilance, you can achieve financial success and stability. Remember, strong credit is a powerful tool in your financial arsenal, capable of driving both personal growth and business expansion.

Work With Joe Martin

Work Directly With Our Chief Executive

Are you ready to take your life and business to the next level? Look no further than our Chief Executive, Mr. Joe Martin. With nearly two decades of experience, Joe has a proven track record of helping individuals and businesses achieve greatness. And for a limited time, you have the exclusive opportunity to work directly with him.

Joe's expertise is unmatched, and he has a deep understanding of what it takes to succeed in today's fast-paced and ever-changing world. He has helped countless people overcome their obstacles and achieve their goals, and he can do the same for you.

Don't miss out on this chance to work with a true hero in the world of business. Take advantage of this opportunity today and start your journey towards greatness.

© 2023 Joe Martin & Associates - All Rights Reserved,